Just Listed – 6 Sunlake Way SE

Welcome to Sundance!

Quick Details:

– Listed at $ 414,900

– 1851 Total Square Feet

– 3 Bedrooms

– 2.5 Bathrooms

– Double Attached Garage

Take a virtual walk through of 6 Sunlake Way SE.

Walk to the lake! This well designed layout offers a sunken living room with gas fireplace, formal dining room, and spacious kitchen with new stainless appliances, move-able island and a sunny breakfast nook.

Three bedrooms and two beautifully renovated bathrooms (including a 4-piece en-suite) complete this floor. Downstairs you will find a large rec room with a gas fireplace, exercise area and 2-piece bath with potential to add a shower.

An additional two bedrooms could be created on the lower level. Tons of storage in the utility room and fully finished garage.

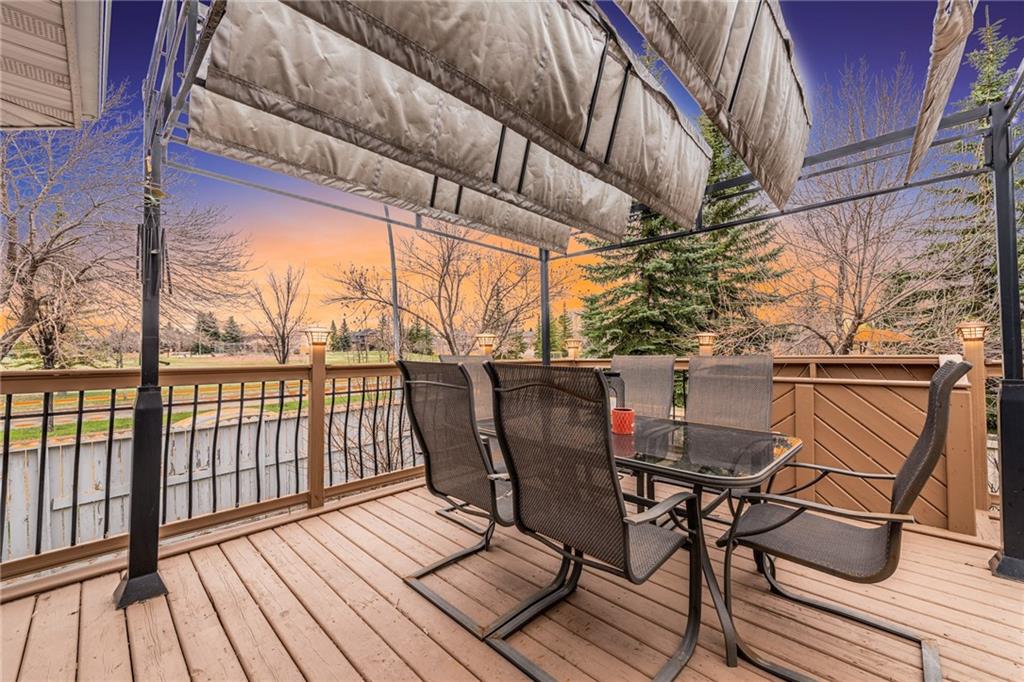

Step outside to BBQ on the large deck and seek shade under the pergola.

Take a virtual walk through of 6 Sunlake Way SE.

Contact today to book your private viewing!

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403.703.1052

Listed with Redline Real Estate Group

CREB® Statistics – COVID-19 weighing on housing market

The Calgary Real Estate Board (CREB®) has released their statistic report for March 2020. A couple of quick statistics to take away from the article:

- By the end of March, sales activity had fallen 11 per cent compared to last year. This is 37 per cent lower than long-term averages. The drop in sales pushed March levels to the lowest recorded since 1995.

- Prices were already forecasted to ease this year due to oversupply in our market. In March, the citywide benchmark price was $417,400. This is nearly one per cent lower than last year’s levels.

- New listings dropped by 19 per cent this month. This decline in new listings compared to sales caused supply levels to ease and helped prevent a larger increase in oversupply. Overall, the months of supply remain just below five months, similar to levels recorded last year.

For the full report, continue below. As always, if you’re interested in finding out what these statistics mean for you and your specific property, feel free to get in touch with me at any time; sparanych@outlook.com or 403.703.1052.

After a strong start to 2020, economic conditions have dramatically changed, as COVID-19 is impacting all aspects of society.

The economic impact is starting to be felt across many industries. This includes the housing market.

March sales activity started the month strong, but quickly changed, as concerns regarding the spread of COVID-19 brought about social distancing measures. This had a heavy impact on businesses and employment.

“This is an unprecedented time with a significant amount of uncertainty coming from both the wide impact of the pandemic and dramatic shift in the energy sector. It is not a surprise to see these concerns also weigh on the housing market,” said CREB® chief economist Ann-Marie Lurie.

By the end of March, sales activity had fallen 11 per cent compared to last year. This is 37 per cent lower than long-term averages. The drop in sales pushed March levels to the lowest recorded since 1995.

“The impact on the housing market will likely persist over the next several quarters,” said Lurie. “However, measures put in place by the government to help support homeowners through this time of job and income loss will help prevent more significant impacts in the housing market.”

New listings dropped by 19 per cent this month. This decline in new listings compared to sales caused supply levels to ease and helped prevent a larger increase in oversupply. Overall, the months of supply remain just below five months, similar to levels recorded last year.

Prices were already forecasted to ease this year due to oversupply in our market. In March, the citywide benchmark price was $417,400. This is nearly one per cent lower than last year’s levels. The reduction in both sales and new listings should help prevent significant price declines in our market.

However, price declines will likely be higher than originally expected due to the combined impact of the pandemic and energy sector crisis.

HOUSING MARKET FACTS

Detached

- Detached sales eased by 15 per cent this month, driven by pullbacks in all districts except the North, which remained flat compared to last year.

- The decline in sales was met with a larger decline in new listings, causing inventories to fall by 17 per cent and keeping the months of supply slightly lower than last year’s levels.

- Detached benchmark prices have remained relatively unchanged compared to last year at $480,800. Price declines this month continue to be the highest for the City Centre, North East and West districts.

Apartment

- With 217 citywide apartment sales in March, this was the only category to record a year-over-year gain. Much of the gain was due to improving sales in the South, South East and North West districts.

- New listings this month did ease, helping support a small decline in inventory levels.

- Persistent oversupply has resulted in continued downward pressure on prices. In March, the citywide benchmark price eased by more than two per cent compared to last year for a total of $243,700.

Attached

- Both semi-detached and row sales declined this month compared to last year. Like the other property types, there was also a significant reduction in new listings.

- The decline in new listings helped push down inventory levels for both property types, but it was not enough to prevent a rise in the months of supply.

- However, this segment was oversupplied prior to the recent changes, impacting prices. As of March, prices remained nearly one per cent lower than last year’s levels for both semi-detached and row properties.

REGIONAL MARKET FACTS

Airdrie

- Like many other areas, Airdrie saw a decline in sales activity, along with a reduction in new listings and inventory. The reductions in supply and demand helped prevent any significant changes to the months of supply.

- While the full impact of the COVID-19 crisis has not yet played out in the housing market, March prices remained comparable to last year’s levels.

Cochrane

- Both sales and new listings fell this month compared to last year, causing inventories to fall to the lowest levels in five years. Like many other markets, Cochrane remains oversupplied, with easing prices.

- The March benchmark price was $398,700. This is nearly two per cent lower than the previous year.

Okotoks

- Trends changed this month, with flat sales and a decline in new listings. The decline in new listings was enough to cause a significant reduction in supply levels and the months of supply fell below five months.

- Prices are trending down on a monthly basis, but remain comparable to last year’s levels, with a March benchmark price of $405,000.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403-703-1052

Source: CREB®

CREB® Statistics – Calgary housing market still favours the buyer

The Calgary Real Estate Board (CREB®) has released their statistic report for November 2019. A couple of quick statistics to take away from the article:

- The detached unadjusted benchmark price was $481,500 in November, slightly lower than last month’s levels and two per cent below last year’s prices.

- Apartment sales pulled back this month, causing year-to-date sales to remain comparable to last year’s levels and 21 per cent below long-term averages.

- While the amount of supply in the market continues to ease, the persistent oversupply continues to weigh on prices.

For the full report, continue below. As always, if you’re interested in finding out what these statistics mean for you and your specific property, feel free to get in touch with me at any time; sparanych@outlook.com or 403.703.1052.

Year-to-date residential sales in the city remain just above last year’s levels due to improvements in the attached sector so far this year.

However, November sales activity eased over last year’s levels, mostly due to pullbacks in the apartment sector.

Meanwhile, new listings eased enough relative to sales to cause inventories to ease and the amount of oversupply to come down slightly compared to last year’s levels.

“Achieving more stable conditions will take time. Sales activity has been settling in at lower levels and is likely being influenced by the economic conditions and uncertainty weighing on our market,” said CREB® chief economist Ann-Marie Lurie.

“While the amount of supply in the market continues to ease, the persistent oversupply continues to weigh on prices.”

As of November, the citywide unadjusted benchmark price was $419,100. This is just below last month’s levels and two per cent lower than last year’s levels.

Market conditions continue to vary depending on price, location and product type. For example, prices have ranged from a year-to-date decline of nearly eight per cent for row product in the East district to a two per cent increase for semi-detached product in the North district.

Larger price declines are often caused by high supply in the new-home and resale markets relative to demand.

HOUSING MARKET FACTS

Detached

- Detached sales improved in November over last year’s levels, mostly due to growth in the $400,000 – $500,000 range. However, sales in November and overall activity remain low by historical standards.

- Despite some recent gains in sales activity, year-to-date sales remain comparable to last year’s levels and 20 per cent below longer-term trends. However, detached sales have improved in both the North West and South districts this year.

- Improving sales, combined with further declines in new listings, helped reduce inventories in this sector compared to levels recorded last year. However, supply levels remained elevated based on seasonal comparisons.

- Like some of the other sectors, the detached market is slowly moving toward more balanced conditions. However, it is still oversupplied, and this trend continues to weigh on prices.

- The detached unadjusted benchmark price was $481,500 in November, slightly lower than last month’s levels and two per cent below last year’s prices.

Apartment

- Apartment sales pulled back this month, causing year-to-date sales to remain comparable to last year’s levels and 21 per cent below long-term averages.

- The monthly decline in sales was mostly driven by pullbacks in the City Centre, North West and South East districts. However, on a year-to-date basis, sales activity improved in the North, West and South East districts.

- New listings rose across most districts, causing city-wide inventory gains this month. Much of the gains were a result of a rise in new-home listings filtering into the resale market. Despite the monthly shift, year-to-date new listings and inventories remain lower than last year’s levels.

- Weaker sales, combined with rising inventories, pushed November months of supply to over seven months. This is higher than last year’s levels of more than five months.

- Persistent oversupply in this sector caused prices to ease. The year-to-date benchmark price declined by more than two per cent.

Attached

- Year-to-date sales remain more than six per cent higher than last year’s levels and just below long-term averages.

- New listings eased this month compared to last year and sales improved. Inventories continue to ease from the monthly highs recorded last year. While the attached market remains oversupplied, the market continues to improve over last year’s levels.

- November semi-detached prices eased by two per cent compared to last year. The largest year-over-year declines occurred in the City Centre district.

- Row prices eased by nearly four per cent compared to last year. Annual declines ranged from more than seven per cent in the North East district to nearly two per cent in the North West and East districts.

REGIONAL MARKET FACTS

Airdrie

- Sales activity continue to improve in November compared to last year. This caused year-to-date sales to rise to 1,146 units, an increase over last year and consistent with long-term averages.

- The rise in sales continued to be met with a pullback in new listings, resulting in inventory declines. This helped reduce the months of supply and November levels are much closer to balanced conditions.

- Easing oversupply has helped reduce the downward pressure on prices this month. However, it was not enough to offset earlier declines. The year-to-date benchmark price in Airdrie was $332,345, three per cent below last year’s levels.

Cochrane

- November sales eased compared to the previous year, but it was not enough to offset earlier gains, as year-to-date sales remained just above last year’s levels.

- The notable adjustment this month was in new listings, which eased enough to offset any declines in sales. This caused further inventory reductions compared to last year. While the months of supply did not shift much this month, year-to-date levels have eased from the previous year and remain just above longer-term averages.

- Despite supply reductions, the market remains oversupplied, which continues to weigh on prices. In November, prices the benchmark price was $394,200, lower than last month and more than four per cent below last year’s levels.

Okotoks

- November sales continued to improve over the low levels of activity recorded last year. The steady gains have caused year-to-date sales to rise above last year’s levels but remain below longer-term averages.

- Inventory levels have also been easing, thanks to a rise in sales and reduction in new listings. While the market remains oversupplied, these adjustments are supporting moves toward more balanced conditions.

- Prices in this market have been slower to adjust. In November, the unadjusted benchmark price was $412,100, lower than last month and over two per cent lower than last year.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403-703-1052

Source: CREB®

CREB® Statistics – Shifting to stability

The Calgary Real Estate Board (CREB®) has released their statistic report for September 2019. A couple of quick statistics to take away from the article:

- In the condominium apartment market, sales improved by 16 per cent this month. This represents the segment’s best September since 2015.

- Despite improving sales and reductions in inventory, the overall market remains oversupplied. This continues to weigh on prices.

- Citywide unadjusted benchmark price of $424,900 is two per cent lower than last year’s levels.

For the full report, continue below. As always, if you’re interested in finding out what these statistics mean for you and your specific property, feel free to get in touch with me at any time; sparanych@outlook.com or 403.703.1052.

For the third consecutive month, sales activity improved over last year’s figures, and year-over-year new listings and inventories eased. This trend will help support more stability in the housing market.

“Price declines have likely brought some buyers back into the market,” said CREB® chief economist Ann-Marie Lurie, noting improvements in the market continue to be driven by homes priced below $500,000.

In the condominium apartment market, sales improved by 16 per cent this month. This represents the segment’s best September since 2015. Year-to-date growth in both the attached and apartment sector were enough to offset the modest decline in the detached sector resulting in year-to-date sales growth of nearly one per cent in the city.

Despite improving sales and reductions in inventory, the overall market remains oversupplied. This continues to weigh on prices.

“While housing demand is modestly improving, sales activity remains relatively weak,” said Lurie. “The market is moving toward more stable conditions, but this is mostly related to supply adjustments in the city.”

September inventory levels are still elevated at 6,889 units, but this figure represents a decline of 13 per cent compared to last year. The months of supply in the Calgary market currently sits at five months. These conditions continue to favour the buyer, but not to the same degree seen at this time last year.

September’s citywide unadjusted benchmark price of $424,900 is two per cent lower than last year’s levels.

HOUSING MARKET FACTS

Detached

- Improvements in sales over the past three months were not enough to offset pullbacks that occurred earlier in the year, as year-to-date sales remain nearly one per cent lower than last year’s levels. Despite citywide declines, sales improved in both the North West and South districts, thanks to significant gains in sales of homes priced below $500,000.

- The months of supply remains elevated at over four months, although this is an improvement compared to the same time last year.

- Benchmark prices in September ranged from a year-over-year decline of more than four per cent in the South district to general stability in the North East, North and West districts.

Apartment

- Sales improved by 16 per cent this month, making it the best September recorded in the past three years. Despite recent improvements in sales, year-to-date levels remain stable compared to last year, but well below longer-term trends.

- Condominium apartment sales were varied across the city. Significant growth was reported in the North and South East districts. Both districts have seen significant new-home development which could be influencing resale activity.

- Oversupply continues to weigh on prices in this segment, as unadjusted prices remain 17 per cent below 2014 highs.

Attached

- Sales increases for both semi-detached and row product have improved year-to-date attached sales by more than five per cent compared to last year. It is the only product type that has recorded significant gains year-over-year.

- New listings continue to ease, reducing inventory and the months of supply.

- Despite some annual reductions in the months of supply, buyers’ market conditions persist and prices continue to ease. Year-to-date benchmark price declines ranged from a high of nearly six per cent in the City Centre to a low of three per cent in the North East.

REGIONAL MARKET FACTS

Airdrie

- Conditions in the resale market continue to show signs of growth. Sales activity improved in September, pushing year-to-date sales up by nearly three per cent. New listings eased, which helped reduce inventory in the market.

- The market remains slightly oversupplied, but the months of supply is edging down from last year’s high levels. This is supporting more stability in monthly price movements. As of September, the unadjusted benchmark price was nearly two per cent lower than last year’s levels.

Cochrane

- Sales in the area continue to improve and year-to-date levels remain the third-highest on record. The area faces fewer challenges with demand than the Calgary market, but elevated inventories continue to weigh on prices.

- Inventories are starting to trend down. If this continues, the market should move into more balanced conditions and, eventually, support some price stability.

Okotoks

- Sales activity continues to recover from the low levels recorded last year. Improving sales and easing new listings are causing year-over-year inventory declines and reducing oversupply in the market.

- The market has been trending into balanced conditions, but prices have been slow to react. Year-to-date benchmark prices remain just over four per cent lower than last year’s levels.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403-703-1052

Source: CREB®

Just Listed – #7, 3402 Parkdale Boulevard NW

Welcome to Parkdale!

Quick Details:

– Listed at $298,000

– 1062 Square Feet

– 2 Bedrooms

– 1 Bathroom

– Underground Parking

Enjoy one of the best views in the city from your private second story patio overlooking the Bow River Pathway in Parkdale’s highly-desirable and flood free Golden Triangle!

The efficient and intelligently designed 2 bedroom, 1 bathroom layout uses every inch to maximize light and square footage. It’s the largest unit listed in the building and includes a wood burning fireplace, in-suite laundry, brand new windows and patio door with a phantom screen.

Only 10 minutes from every post-secondary in the city, a short walk to Foothills and Children’s Hospital or an easy 10 minute commute to downtown.

With a sizeable storage locker, underground parking, a healthy reserve fund and a well managed condo board, this building is as well cared for as the unit itself. Convenience of inner city combined with an unbeatable connection to the mountains!

View the full listing details for #7, 3402 Parkdale Blvd NW

Contact today to book your private viewing!

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403.703.1052

CREB® Statistics – Sales improving and inventory declines for fourth month in a row

The Calgary Real Estate Board (CREB®) has released their statistic report for July 2019. A couple of quick statistics to take away from the article:

- Reduction in inventory has caused the months of supply in July to ease to 4.5 months, a significant improvement from the 5.5 months recorded last year.

- Year-to-date sales for detached products priced below $500,000 have improved by 11 per cent compared to last year.

- The attached sector is the only sector with recorded growth in year-to-date sales, up nearly four per cent. The affordable nature of this product, relative to detached, has likely supported some of these gains.

For the full report, continue below. As always, if you’re interested in finding out what these statistics mean for you and your specific property, feel free to get in touch with me at any time; sparanych@outlook.com or 403.703.1052.

For the fourth consecutive month, inventories in the market declined compared to last year. This is due to the combination of improving sales and a decline in new listings.

The market continues to favour the buyer, but a continuation in supply reduction compared to sales is needed to support more balanced conditions.

“We are starting to see reductions in supply across the resale, rental and new-home markets,” said CREB® chief economist Ann-Marie Lurie.

“This adjustment in supply to the lower levels of demand will support more balanced conditions. It is starting to support more stability in prices. If this continues, the housing market should be better positioned for recovery as we move into 2020.”

Year-to-date sales activity remains just below last year’s levels and well below longer-term averages. However, the reduction in inventory has caused the months of supply in July to ease to 4.5 months, a significant improvement from the 5.5 months recorded last year.

With less oversupply in the market, prices are showing some signs of stability on a monthly basis. This is causing the rate of price decline to ease on a year-over-year basis. Overall, year-to-date benchmark prices remain over four per cent below last year’s levels.

HOUSING MARKET FACTS

Detached

- Sales activity in July was slightly higher than last year’s levels, but it was not enough to offset earlier declines, as year-to-date sales remain just below last year’s levels. Despite overall declines, trends vary significantly by price range. Year-to-date sales for product priced below $500,000 have improved by 11 per cent compared to last year, while sales over $500,000 have declined by nearly 16 per cent.

- New listings continue to ease for detached product, reducing inventory across most price ranges. This is also starting to result in year-over-year declines in the months of supply for all prices ranges except homes over $1 million.

- Adjustments in sales and inventories also vary significantly by district. Year-to-date sales have declined across all districts except the North West and South districts. Easing inventories have not occurred across all districts, with year-over-year July inventory gains occurring in both the City Centre and West districts.

- Buyers’ market conditions persist, with detached benchmark prices at $488,400 in July. This is over three per cent lower than last year’s levels. Price declines range from a high of 5.7 per cent in the South district to a low of 1.4 per cent in the North East district.

Apartment

- Despite improvement in July, year-to-date sales for apartment condominiums eased by over four per cent and remain well below longer-term averages.

- Available rental supply and ample selection in the new-home sector have impacted sales in the resale market. However, inventories continue to adjust, reducing the oversupply in this sector.

- With conditions favouring the buyer, prices continue to edge down. However, year-to-date benchmark price declines are not occurring across all districts, with modest gains occurring in the North East district.

Attached

- The attached sector is the only sector with recorded growth in year-to-date sales, up nearly four per cent. The affordable nature of this product, relative to detached, has likely supported some of these gains.

- The number of new listings continues to ease. This is causing inventory declines and reductions in oversupply. Like the other sectors, this segment continues to favour the buyer, preventing any significant changes in prices.

- Both row and semi-detached prices remain over three per cent lower than last year’s levels and well below historical highs. Attached price declines have been the highest in the City Centre district at over five per cent.

REGIONAL MARKET FACTS

Airdrie

- For the fifth consecutive month, year-over-year sales improved in Airdrie. Year-to-date sales reached 757 units, over three per cent higher than last year. Improving sales combined with declines in new listings have resulted in less inventory in the market compared to last year. This market is moving toward balanced conditions.

- Oversupply is easing, but July benchmark prices remain over three per cent below last year’s levels. There are steeper price declines occurring in the higher density sectors of the market.

Cochrane

- Year-to-date residential sales in Cochrane totalled 376 units, slightly lower then last year’s levels. New listings have been in decline, resulting in the fourth consecutive month with a year-over-year decline in inventory.

- This has caused the amount of oversupply to ease, supporting more stability in pricing. As of July, the benchmark price in Cochrane is $408,300, over four per cent lower than last year’s levels.

Okotoks

- Total residential sales in Okotoks have totalled 321 units so far in 2019. This is similar to last year, but below long-term trends. New listings continue to trend down, supporting inventory declines and easing in the months of supply.

- As the amount of oversupply in the market eases, prices have been showing signs of improvement compared to the previous month. However, year-to-date benchmark prices remain over four per cent lower than last year’s levels.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403-703-1052

Source: CREB®

CREB® Statistics – Oversupply is slowing, but a buyers’ market remains

The Calgary Real Estate Board (CREB®) has released their statistic report for June 2019. A couple of quick statistics to take away from the article:

- As of June, the benchmark price in the city was $425,700, nearly four per cent below last year’s levels

- While the market still favours the buyer – with 4.3 months of supply – the amount of oversupply has eased and is slowing the decline in prices.

- Detached homes priced under $500,000 have recorded improvements in sales and oversupply reductions.

For the full report, continue below. As always, if you’re interested in finding out what these statistics mean for you and your specific property, feel free to get in touch with me at any time; sparanych@outlook.com or 403.703.1052.

New listings coming onto the market continued to decline in June, which is helping to reduce the oversupply of homes in Calgary.

Year-over-year, new listings saw a decrease of nearly 19 per cent. Sales activity slowed this month compared to last year by six per cent, but the pullback in new listings was enough to cause inventories to fall by 13 per cent compared to last year’s elevated levels.

“So far, the housing market has generally behaved as expected this year. Sales activity remains just below last year’s levels, prices have eased and supply is starting to adjust to the lower level of sales,” said CREB® chief economist Ann-Marie Lurie.

“However, it is mostly product priced under $500,000 that is trending towards more balanced conditions.”

While the market still favours the buyer – with 4.3 months of supply – the amount of oversupply has eased and is slowing the decline in prices. As of June, the benchmark price in the city was $425,700, nearly four per cent below last year’s levels and comparable to unadjusted prices recorded last month.

HOUSING MARKET FACTS

Detached

- Detached sales in June declined by nine per cent compared to last year, causing year-to-date sales to ease by nearly three per cent. The decline in sales was mostly driven by homes priced above $500,000.

- Detached homes priced under $500,000 have recorded improvements in sales and oversupply reductions. The tightening in the lower end of the market will likely start to support price growth in this sector of the market.

- Despite city wide year-to-date sales declines, activity improved in both the South and North West districts of the city. Sales did ease across other districts, but in some of the most affordable districts (North East and East) supply-to-demand ratios are improving compared to last year. This is pushing those markets toward more balanced conditions.

- Despite slower sales activity, the amount of inventory declined by nearly 18 per cent. The reduction in inventories occurred throughout all districts.

- Prices have remained relatively stable over the past few months, with some modest monthly improvements. However, the oversupply scenario has left prices nearly four per cent below last year’s levels.

Apartment

- Apartment condominium sales eased in June, causing year-to-date sales to total 1,292 units. This is over seven per cent below last year’s levels. Over the same time frame, new listings eased by over 15 per cent, helping reduce some of the resale inventory in the market.

- Resale inventory levels have declined, but the months of supply continue to remain elevated at 6.8 months. Combined with elevated inventories in the competing rental and new-home markets, this continues to weigh on resale pricing.

- June’s benchmark price was $250,200, three per cent below last year’s levels. This is resulting in a total price adjustment of over 17 per cent since 2014.

Attached

- Unlike other property types, sales activity for attached product continued to improve in June. Year-to-date sales total 1,955 units, nearly three per cent above last year’s levels. Improvements were driven mostly by growth in demand for semi-detached product. Attached sales improved across all districts except the North West and West.

- New listings have eased compared to last year, which is starting to reduce oversupply in the market. Like all other sectors, the attached market remains oversupplied and this is impacting prices.

- June’s benchmark prices were $399,700 for semi-detached and $286,300 for row product. Respectively, this represents year-over-year declines of 3.3 and 5.4 per cent.

REGIONAL MARKET FACTS

Airdrie

- After the first half of the year, sales activity remained relatively stable. New listings have declined, which is helping to reduce the amount of inventory on the market and move towards more balanced conditions.

- The market may be trending towards more balanced conditions, but oversupply continues to weigh on prices. The benchmark price was $334,800 in June, comparable to last month, but nearly three per cent below last year’s levels.

Cochrane

- Sales activity in the area remained relatively stable compared to last year and consistent with longer-term trends. New listings have eased, helping to reduce inventory in the market and the amount of oversupply.

- Despite some recent adjustments, the market continues to favour the buyer, placing downward pressure on prices. The benchmark price was $404,000 in June, similar to last month and over five per cent below last year’s levels.

Okotoks

- Sales have remained stable compared to last year, but they are still below longer-term averages. However, new listings are starting to adjust, which is continuing to push down inventory levels and cause the market to move towards more balanced conditions.

- As the market moves towards more balanced conditions, this should help create more stability in pricing. As of June, benchmark prices were $414,900, 1.6 per cent higher than last month, but still 4.1 per cent below last year’s levels.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Sarah Paranych

sarah.livelovecalgary.com

sparanych@outlook.com

403-703-1052

Source: CREB®

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link